No festive family gathering would be complete without elder relatives waxing lyrical over “the good old days”, as millennials mumble anxiously about their future. Baby boomers were indeed a lucky bunch. After the second world war, many were able to accumulate substantial fortunes as fast-growing economies propped up earnings, real estate values, and stock markets. By contrast, younger generations today have been hit by low productivity growth and several economic crises, from the 2008 financial crash to the Covid-19 pandemic. Many young adults cannot afford their own digs. And to top it off, there is the threat of climate change and geopolitical instability.

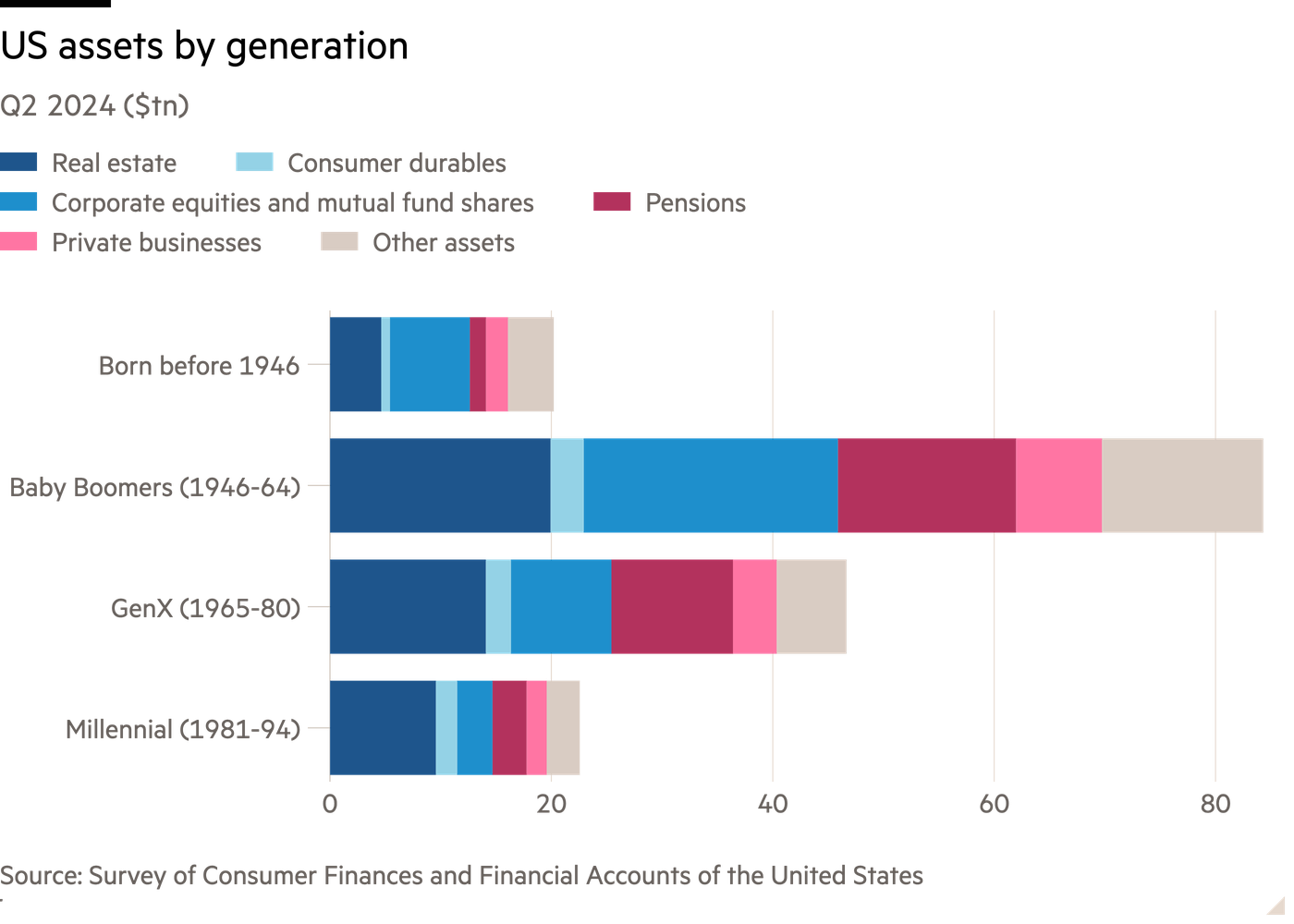

But mom, dad and the grandparents’ good fortune — and, of course, their hard work — means millennials and Gen-Z do have something to look forward to: a decent inheritance. In the next 25 years, over $100tn in assets — ranging from property, aged wines and artwork — will be transferred from the boomers and older generations to their heirs in the US alone, according to Cerulli Associates, a wealth manager. Vanguard — another such firm — recently projected that over $18tn in wealth will be handed down globally by 2030. It will be the largest intergenerational transfer of assets in history.